tax saving strategies for high income earners canada

Here are five tax saving tips that are easy to apply. Tax Saving Strategies for High-Income Earners.

How To Calculate Foreigner S Income Tax In China China Admissions

To prevent passive investment income unrelated to the active nature of the business from being unduly spared from taxation the CRA has put a policy in place that will see the 500000 SBD threshold rolled back by 5 for every 1 of passive income earned inside the corporation in excess of 50000 per annum thereby exposing more business income to higher.

. Female Percentage of High-Income Canadians. Be diligent about your record-keeping to avoid lost receipts that can mean missing out on tax deductions. Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for individuals whose adjusted gross income exceeds 1 million.

For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep after-tax dollars in their hands versus more of their income going to. Establish retirement accounts One of best ways for high earners to save on taxes is to establish and fund retirement accounts. Convert your SIMPLE SEP or traditional IRA to a Roth IRA.

Additionally tax-deferred accounts benefit by compounding returns faster by sheltering income from current taxation. Contributions to an RRSP lower your taxable income. One such option is the allocation of bonds to RRSPs and TFSAs since the interest is fully taxable.

Change the Character of Your Income One way to reduce your tax burden is to change the character of your income. Heres some other ways to reduce tax. High income earners in Canada will benefit immensely from moving their assets being taxed at a higher level into tax sheltered accounts.

If properly structured family trusts or partnerships can help you move your investment earnings to family members with lower marginal tax rates. Keeping electronic copies of scanned receipts can help you stay organized on the go but file your hard copies as well in case you get audited. Registered Retirement Savings Plans RRSPs Registered Education Savings Plans RESPs and Tax-free Savings Accounts TFSAs.

Canadian tax law allows for several ways to reduce your taxes owed if you know the current rules and can take advantage of them. This has to generally be done within annual gift exclusions or loans. File Simple Tax Returns Online For Your Max Refund Guaranteed.

Canadians who earn more than 200000 per year face personal income tax rates upwards of 50 percent. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts. The math is simple.

You can deduct the amount you contribute to a tax-qualified retirement account from your income taxes except for Roth IR As and Roth 401 ks. David Rotfleisch founding tax lawyer of Toronto firm Rotfleisch and Samulovitch recommends Registered Retirement Savings Plans RRSPs to everyone. Across all Canadians the average tax rate has hovered around the 15 to 20 range.

As of the 2014 tax year couples who have at least one child under 18 can effectively transfer up to 50000 of taxable income to their lower-income partner and claim a non-refundable tax credit. One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of current and future year contributions and deduct them all in the current year. Two a spousal loan strategy which enables your lower income spouse to earn investment income at their lower tax rate.

Income splitting with family members is a simple and effective tax planning strategy. If the RRSP or TFSA has remaining contribution room after purchasing bonds can consider buying stock. Tax Planning Strategies For High-Income Canadians Registered Education Savings Plan RESP.

Sheltering investment income. For the nations highest-income earners those making more than 220000 annually the amount going to the tax man is. However prior to the 2018 federal budget high earning individuals enjoyed two effective strategies to reduce their overall tax burden income splitting and reinvesting undistributed earnings from an active business into a private corporation.

One a family trust which enables you to provide funds for your children or grandchildrens needs while reducing taxes. Typically the RRSP is more beneficial to higher-income earners. So here are some tax tips to help you do just that.

The more money you make the more taxes you pay. Further there will generally be no income. If youre wondering why you should do so here are some of the ways it can help you to lower your tax bill.

Tax-Free Savings Account TFSA In addition to investing in a TFSA of your own consider making a gift to your adult family members or spouse to enable them to contribute to a TFSA. For any Canadian with the ability to save money sheltering income from the taxman in one of the two main savings vehicles the government makes available is a no-brainer. If you need to pay for your childrens post-secondary education you should.

Each plan defers or mitigates tax obligations in different ways. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. A family with two adults and three children will also have a very high tax rate.

Canadas highest income earners those in the top 10 are paying effective tax rates of 25 to 40. The RRSP can be a great way for higher-income earners to get a hefty tax return but can also be a way for Canadians in any tax bracket to pay less money to the government. Contributing to a retirement plan deducting interest and small.

In contrast the bottom 50 pays an income tax rate of roughly 5. All the investment income in the TFSA grows tax-free and future withdrawals are not taxable. Income splitting and trusts This is one of the most important tax strategies for you as a high-income earner.

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

Why Do People Say That Half Your Salary Goes To Taxes In Canada Say Your Income Is 100k Should You Expect To Take Home 4k Per Month After Taxes Quora

Tfsa Vs Rrsp How To Choose Between The Two 2022 Canadian Money Personal Finance Blogs Personal Finance

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

Personal Income Tax Brackets Ontario 2021 Md Tax

What Are Real Assets And How To Diversify Your Wealth By Investing In Them Investing Diversify Business Management

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

2021 2022 Income Tax Calculator Canada Wowa Ca

Pdf The Canadian Income Taxation Statistical Analysis And Parametric Estimates

Tax Policy And Economic Inequality In The United States Wikipedia

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

High Income Earners Need Specialized Advice Investment Executive

Tax Minimisation Strategies For High Income Earners

Taxes In Switzerland Income Tax For Foreigners Academics Com

Effective Tax Functions Individuals 2015 Download Scientific Diagram

Personal Income Tax Brackets Ontario 2020 Md Tax

How Do Taxes Affect Income Inequality Tax Policy Center

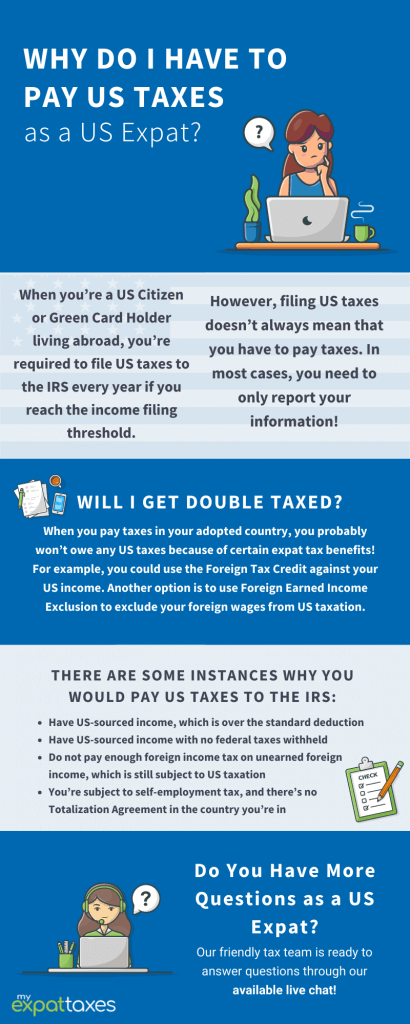

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Corporate Income Taxation And Inequality Review And Discussion Of Issues Raised In The Triumph Of Injustice How The Rich Dodge Taxes And How To Make Them Pay 2019 Faccio Review